Which Details Are Essential To An Objective Summary Of This Excerpt? Check All That Apply.

Note: This article is for the new 2022 curriculum. For previous year's info, check out our article on 2020-2021 CFA curriculum changes.

The new 2022 CFA curriculum is now out for all 3 levels, with 2022 exam registration open.

We have carefully gone through all the 2022 learning outcome statements (LOS) for each level, and compared them to 2020/2021's, so you don't have to! ☕

So here's a quick summary of the latest 2022 CFA curriculum changes and topic weights for all Levels that you need to know.

Some fun facts on the recent 2022's CFA curriculum updates for all levels:

- Corporate Finance is renamed as Corporate Issuers (?!),

- Ethics has been moved to last study session (finally).

Read on to find out more!

- Why Are Curriculum Changes and Topic Weights Important?

- CFA Level 1 Topic Weights

- CFA Level 1 Curriculum Changes

- CFA Level 2 Topic Weights

- CFA Level 2 Curriculum Changes

- CFA Level 3 Topic Weights

- CFA Level 3 Curriculum Changes

Why Are Curriculum Changes and Topic Weights Important?

Topic weights are key to CFA study plans, as it guides candidates on the importance of each topic for the exams. Needless to say, higher weighted topics deserve more study time, focus and practice.

Knowing the curriculum changes in advance are useful in certain circumstances, for example:

- Candidates who have yet to register for the 2022 exam, yet want to get a head start on reading existing 2020/2021 materials (remember that CFA Institute kept the 2021 curriculum the same as 2020's due to COVID-19). They need to make sure that what they are studying now will be part of the updated curriculum;

- Candidates who are interested in getting second hand, previous year versions of third party study materials for the next exam; or

- Candidates who (unfortunately) failed a current year exam, and are planning to retake in 6-12 months time. Existing third party study materials may be re-used if the curriculum changes are minor between these 2 years.

Here are the quick summaries of the topic weights and curriculum changes that you need to know for your exam.

For each level, there is also a free 1 pager summary PDF you can download at the end of each section.

CFA Level 1 Topic Weights

There is no change to 2022's CFA level 1 topic weights compared to 2021's.

Note that in 2021, CFA Institute changed CFA Level 1's topic weights to be a range rather than an absolute % as per previous years.

Looking back to 2018-2019, there were big changes whereby Financial Reporting & Analysis and Quantitative Methods' weightings were reduced significantly, to provide a more balanced topic range.

These changes may have been done to discourage candidates from completely ignoring topics such as Derivatives and Alternative Investments for Level 1 preparations.

CFA Level 1 Topic Weights (vs. Previous Years)

| Topics / Weight | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Quant Methods | 12% | 10% | 10% | 8-12% | 8-12% |

| Economics | 10% | 10% | 10% | 8-12% | 8-12% |

| FRA | 20% | 15% | 15% | 13-17% | 13-17% |

| Corp Fin / Issuers | 7% | 10% | 10% | 8-12% | 8-12% |

| Equity | 10% | 11% | 11% | 10-12% | 10-12% |

| Fixed Income | 10% | 11% | 11% | 10-12% | 10-12% |

| Derivatives | 5% | 6% | 6% | 5-8% | 5-8% |

| Alt. Investments | 4% | 6% | 6% | 5-8% | 5-8% |

| Portfolio Mgmt. | 7% | 6% | 6% | 5-8% | 5-8% |

| Ethics | 15% | 15% | 15% | 15-20% | 15-20% |

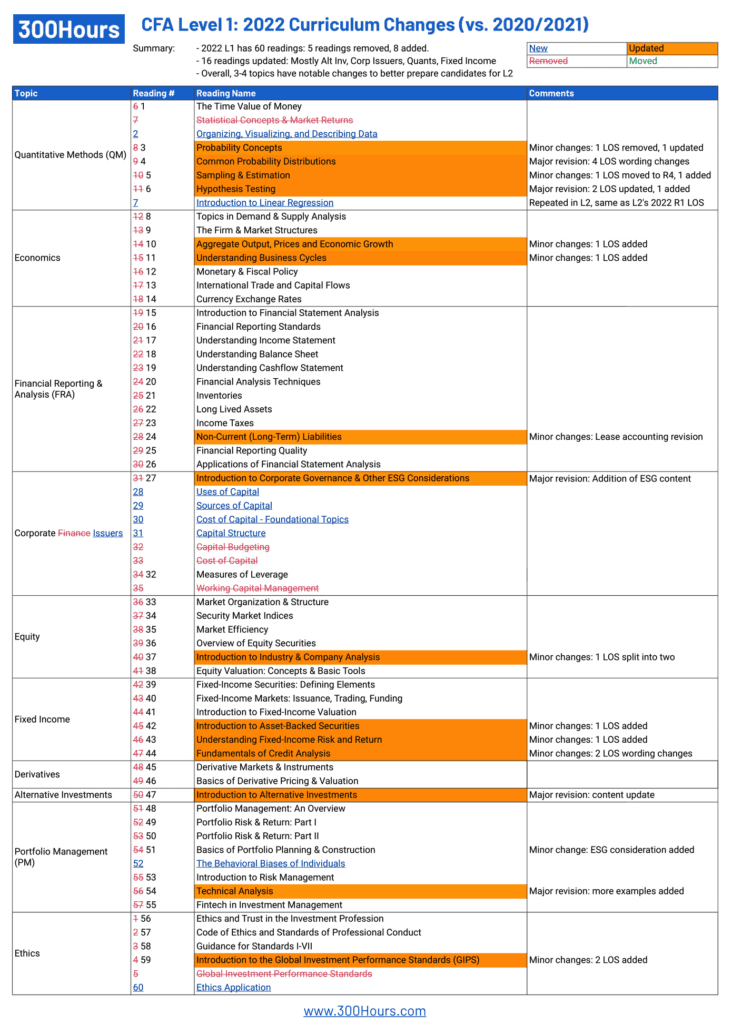

CFA Level 1 Curriculum Changes

In short, there has been lots of small updates throughout the Level 1 curriculum, but nothing major overall. Some notable changes:

- Environmental, social, and governance (ESG) coverage at Level 1 was updated and expanded to cover the most recent developments and their impact on investment management.

- The Level 1 Quantitative Methods topic area was revised to be more engaging and digital-friendly. It also now includes code snippets as well as Excel commands to support the data presentation. Level 1 now ends with a new Introduction to Regression reading that focuses on investment applications.

- Fixed Income readings were revised across all levels to align for ease of reading and consistency.

- The Alternative Investments readings have been updated to include a new introductory reading.

There are 60 readings in 2022's Level 1 Curriculum (vs. 57 in 2020/2021):

- 5 readings from 2020/2021 were removed:

- Reading 5 – Global Investment Performance Standards

- Reading 7 – Statistical Concepts & Market Returns

- Reading 32 – Capital Budgeting

- Reading 33 – Cost of Capital

- Reading 35 – Working Capital Management

- 8 new readings were added (mostly in Quant Methods and Corporate Issuers):

- Reading 2 – Organizing, Visualizing, and Describing Data

- Reading 7 – Introduction to Linear Regression

- Reading 28 – Uses of Capital

- Reading 29 – Sources of Capital

- Reading 30 – Cost of Capital – Foundational Topics

- Reading 31 – Capital Structure

- Reading 52 – The Behavioral Biases of Individuals

- Reading 60 – Ethics Application

- 16 readings were updated: mostly minor changes, except Alternative Investments.

Overall, the 2022's CFA Level 1 curriculum changes are nothing major, with 3-4 topics updated to better prepare candidates for a smoother transition to Level 2.

Quant Methods, Corporate Issuers (previously Corporate Finance), Alternative Investments and to a small extent Ethics have notable changes from 2020/2021's curriculum. Other topics remain largely the same as last year's.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

CFA Level 2 Topic Weights

Just like CFA Level 1, there are no changes to 2022's CFA level 2 topic weights compared to 2021's.

This is as expected given historical trends of reducing the variability in topic weight across the 10 topics, with a maximum range difference of 5% per topic.

Based on 2022's topic weighting, it is even possible for the 10 topics to be tested evenly at 10% weighting each for CFA Level 2.

These changes may have been done to discourage candidates from purely just focusing on the (previously) big 5 topics of Level 2 (FRA, Corporate Finance, Equity Investments, Fixed Income and Derivatives).

CFA Level 2 Topic Weights (Changes vs. Previous Years)

| Topics / Weight | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Quant Methods | 5-10% | 5-10% | 5-10% | 5-10% | 5-10% |

| Economics | 5-10% | 5-10% | 5-10% | 5-10% | 5-10% |

| FRA | 15-20% | 10-15% | 10-15% | 10-15% | 10-15% |

| Corp Fin / Issuers | 5-15% | 5-10% | 5-10% | 5-10% | 5-10% |

| Equity | 15-25% | 10-15% | 10-15% | 10-15% | 10-15% |

| Fixed Income | 10-20% | 10-15% | 10-15% | 10-15% | 10-15% |

| Derivatives | 5-15% | 5-10% | 5-10% | 5-10% | 5-10% |

| Alt. Investments | 5-10% | 5-10% | 5-10% | 5-10% | 5-10% |

| Portfolio Mgmt. | 5-10% | 5-15% | 5-15% | 10-15% | 10-15% |

| Ethics | 10-15% | 10-15% | 10-15% | 10-15% | 10-15% |

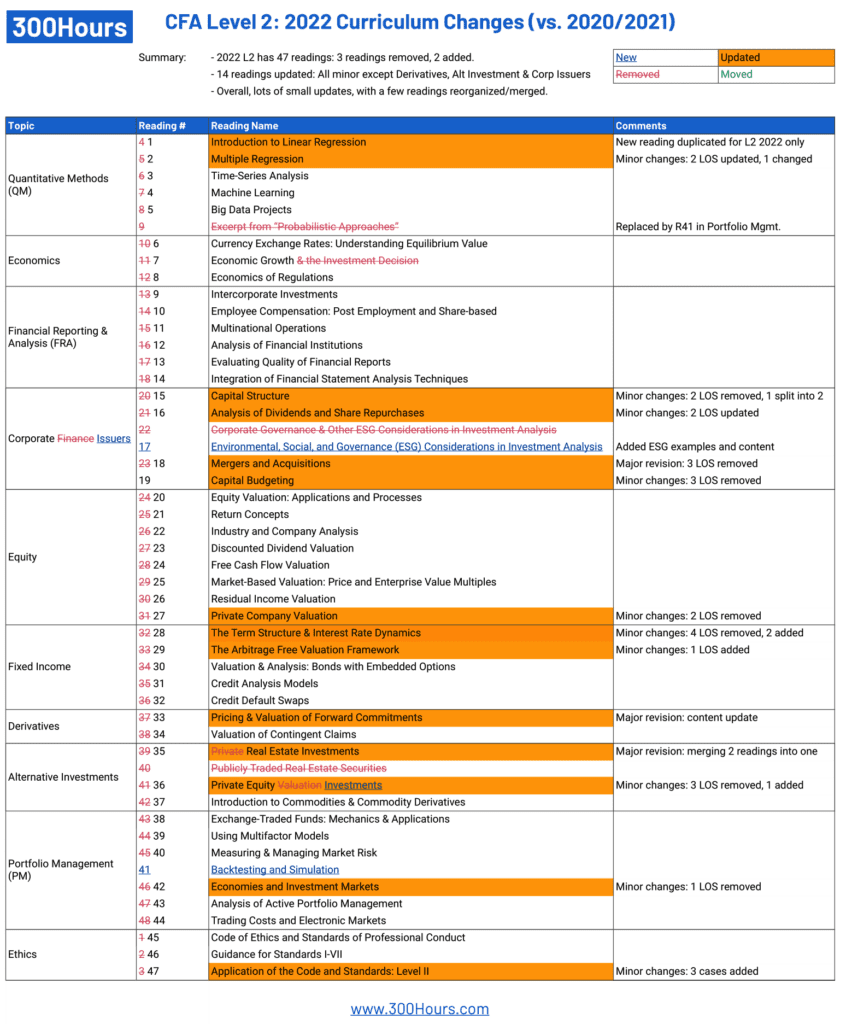

CFA Level 2 Curriculum Changes

In short, Level 2's curriculum experienced a relatively light update this year. Some notable changes:

- Machine Learning has been updated to apply several data cases to investment problems.

- In addition, a new Backtesting & Simulation reading provides an accessible introduction to explain how these tools are used in evaluating investment strategies and to compare their strengths and weaknesses.

- Corporate Finance is renamed as Corporate Issuers, focusing on understanding the motivations, interactions, and impacts on investors of securities issued by corporations. Corporate Issuers brings together foundation areas like economics and financial statement analysis to provide a starting point for equity and fixed income valuation.

- Fixed Income readings were revised across all levels to align for ease of reading and consistency.

- The Alternative Investments readings have been updated to include a single reading on Real Estate and revisions to Private Equity.

There are 47 readings in 2022's Level 2 Curriculum (vs. 48 in 2020/2021):

- 3 readings from 2020/2021 were removed:

- Reading 9 – Excerpt from Probabilistic Approaches

- Reading 22 – Corporate Governance & Other ESG Considerations in Investment Analysis

- Reading 40 – Publicly Traded Real Estate Securities

- 2 new readings were added:

- Reading 17 – Environmental, Social, and Governance (ESG) Considerations in Investment Analysis

- Reading 41 – Backtesting and Simulation

- 14 readings were updated, mostly minor changes, except R33 Pricing & Valuation of Forward Commitments (Derivatives), R18 Mergers and Acquisitions (Corporate Issuers) and R35 Real Estate Investments – the latter due to merging of 2 readings into one.

Overall, 2022 CFA Level 2's curriculum experienced a lot of small updates, with only Derivatives, Corporate Issuers and Alternative Investments experiencing notable changes in some readings.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

CFA Level 3 Topic Weights

Just like CFA Level 1 and 2, there are no changes to 2022's CFA level 3 topic weights compared to 2021's.

This is as expected given historical trends of reducing the variability in topic weight across the 10 topics, with a maximum range difference of 5% per topic.

CFA Level 3 Topic Weights (Changes vs. Previous Year)

| Topics / Weight | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Quant Methods | – | – | – | – | – |

| Economics | 5-10% | 5-10% | 5-10% | 5-10% | 5-10% |

| FRA | – | – | – | – | – |

| Corp Fin / Issuers | – | – | – | – | – |

| Equity | 5-15% | 10-15% | 10-15% | 10-15% | 10-15% |

| Fixed Income | 10-20% | 15-20% | 15-20% | 15-20% | 15-20% |

| Derivatives | 5-15% | 5-10% | 5-10% | 5-10% | 5-10% |

| Alt. Investments | 5-15% | 5-10% | 5-10% | 5-10% | 5-10% |

| Portfolio Mgmt. | 40-55% | 35-40% | 35-40% | 35-40% | 35-40% |

| Ethics | 10-15% | 10-15% | 10-15% | 10-15% | 10-15% |

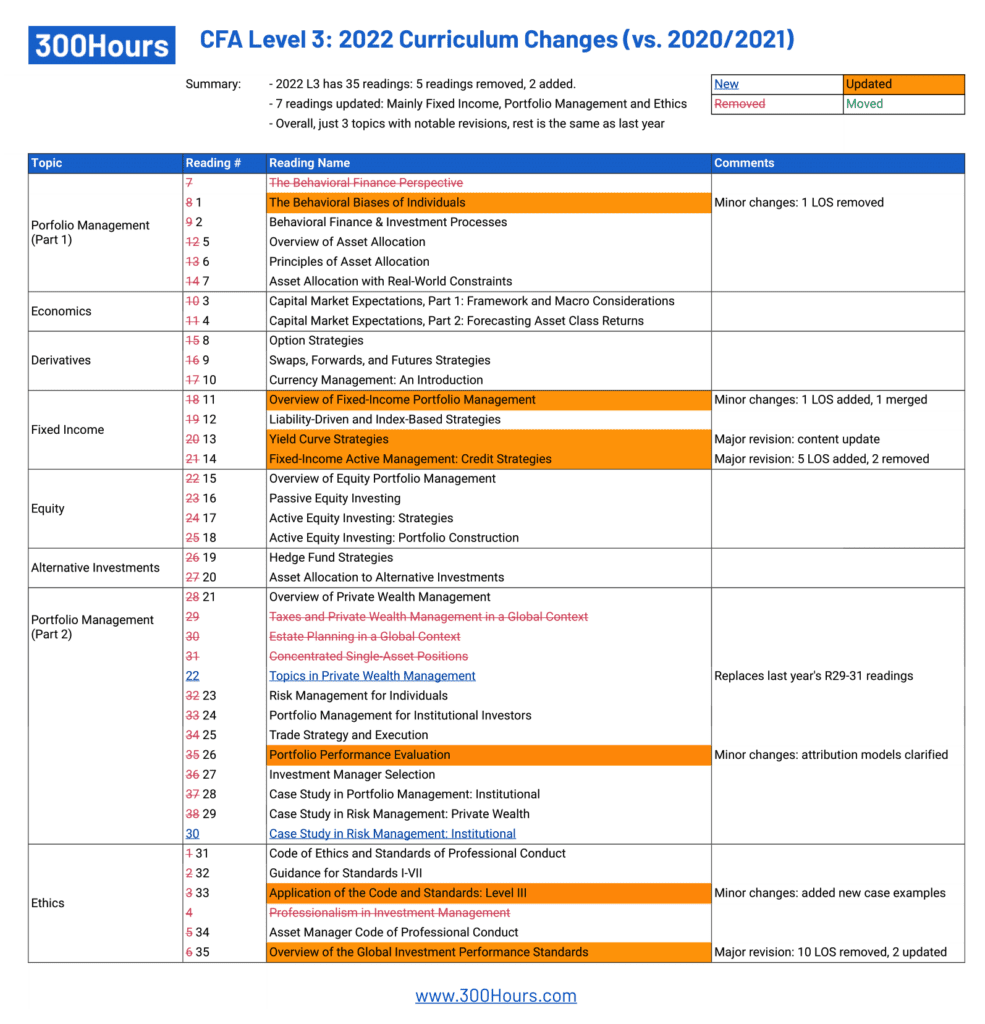

CFA Level 3 Curriculum Changes

In short, there is a much smaller revamp on the Level 3 curriculum this year (compared to last year). Some notable changes:

- Fixed Income readings were revised across all levels to align for ease of reading and consistency. E.g. notation simplification and alignment, elimination of duplication, and updating of concepts such as LIBOR to Market Reference Rates, as well as a complete revision of the challenging Yield Curve Strategies and Credit Strategies readings at Level 3 for clarity and relevance.

- Revisions to Private Wealth Management, Institutional Investors, and Performance Evaluation reflect the new 2020 GIPS standards.

There are 35 readings in 2022's Level 3 Curriculum (vs. 38 in 2020/2021):

- 5 readings from 2020/2021 were removed:

- Reading 4: Professionalism in Investment Management

- Reading 7: The Behavioral Finance Perspective

- Reading 29: Taxes and Private Wealth Management in a Global Context

- Reading 30: Estate Planning in a Global Context

- Reading 31: Concentrated Single-Asset Positions

- 2 new readings were added:

- Reading 22: Topics in Private Wealth Management

- Reading 30: Case Study in Risk Management: Institutional

- 7 readings were updated, mostly major content revisions in Fixed Income and further update of GIPS (Ethics).

Overall, 2022 CFA Level 3 curriculum has notable content changes in Fixed Income, Portfolio Management and Ethics (GIPS reading only).

Other topics remain largely the same as last year's.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

It seems that 2020/2021's CFA books are largely still quite transferable to 2022 (excluding a few chapters with major revisions) – I hope you've found the above useful in your next CFA exam study preparations!

Meanwhile, here are a few related articles of interest for your CFA exam preparations:

- Get Your Free, Customizable CFA Study Planner Now [2022 Curriculum Included]

- 7 Benefits of CFA Charter You Should Know

- CFA Registration: Plan your CFA exams with our Journey Planner

- 2021 CFA Curriculum Changes, Summarized

Which Details Are Essential To An Objective Summary Of This Excerpt? Check All That Apply.

Source: https://300hours.com/2022-cfa-curriculum-changes/

Posted by: tayloralear1996.blogspot.com

0 Response to "Which Details Are Essential To An Objective Summary Of This Excerpt? Check All That Apply."

Post a Comment